Tally erp 9 notes in english pdf free download with examples

What is Tally ?

Tally ERP 9 Notes in English pdf – What is Tally? – Tally is an accounting software developed by Tally Solution Limited Company. Which is used to record and keep the financial transactions of a company, trust or financial transaction institution from computer. So that the financial status of the business will be known.

Full form of Tally –

- Total Accounting Leading List Year

- Transactions Allowed in a Linear Line Yard

What are the different versions of Tally? – Tally ERP 9 Notes English pdf

- Tally 3.0 (1990) – Tally 3.0 is the first version of Tally. Which has been used for basic accounting requirements of small businesses. However, external and special commands are required to run the software. And it only supports Microsoft DOS.

- Tally 3.12 (1991)

- Tally 4 (1992)

- Tally 4.5 (1994)

- Tally 5.4 (1996)

- Tally 6.3 (2001)

- Tally 7.2 (2005)

- Tally 8.1 (2006)

- Tally 9 (2006)

- Tally ERP 9 (2009) – Tally erp9 notes english

Tally ERP 9 is the latest version of Tally since 2009. It is being used by the trade organization. It has advanced features including GST computation, invoicing and payroll processing, remote access, multi-user login and transaction processes. Nowadays businessmen want a complete business solution software like Tally. - Tally Prime (2020) – Tally erp9 notes english

This is the latest version of Tally in which advance has been made from tally erp 9. In which we have prepared QR Code, E-invoice, E-Way Bill, Multi Printing, Bank Cancellation update, Oman VAT, e-payment as well as user friendly interface. For more information, visit the link below.

Tally Prime Notes in Hindi, GST, Voucher Entry, PDF Download

Downloading and Installation of Tally ERP Tally ERP 9 Downloading: – To download Tally ERP 9 download can be downloaded by visiting Tally ERP 9 official website

Basic Accounting Terms – Tally ERP 9 Notes English pdf

Currently the scope of business has expanded considerably. The complexities of financial transactions have also increased in the changing environment of the global economy and business, as a result, it has become necessary for a business organization to keep an account of the regulation of financial practices. It is very difficult and impossible to remember every transaction. This is why bookkeeping emerged. Lucas Pescioli is called the father of bookkeeping.

In India, the work of determining accounting standards and training of accountants is being done by the Institute of Chartered Accountants of India and Institute of Costs and Works Accountants of India.

Meaning and definition of bookkeeping – Tally ERP 9 Notes English pdf

Bookkeeping is also called bookkeeping. This means writing transactions in books. There are many types of monetary transactions in the business which need to be systematically accounted for in books. Regular of all financial transactions of the business, Duly, The art of accounting purely and clearly is called bookkeeping or bookkeeping. Bookkeeping is done on the same day the transaction takes place. Definitions: – According to Carter -”Bookkeeping is the art of properly accounting all those business transactions and is a science, This results in the transfer of the value of the currency. J.J. R. According to Batliboy -”Bookkeeping is the art of accounting business practices under proper headings.

Meaning and Definition of Accounting

Bookkeeping is also called bookkeeping. This means writing transactions in books. There are many types of monetary transactions in business which need to be systematically accounted for in books. The art of regular, methodical, pure and clear accounting of all financial transactions of a business is called bookkeeping or bookkeeping.

Bookkeeping is done on the same day the transaction takes place.

Definitions: – According to Carter – “Bookkeeping is the art and science of properly accounting all business transactions, which results in the transfer of value of money.”

J. R. According to Batliboy – “Bookkeeping is the art of accounting business practices under proper headings.

Objective of Accounting – Tally erp9 notes english

Accounting, As we know, there is a proper accounting in the books of all business practices. Information about all the financial practices related to business and enterprise is obtained through accounting. Its main objectives are as follows –

1. Knowledge of capital: –

2. Knowledge of buying and selling: –

3. Knowledge of debtors and creditors: –

4. Knowledge of the financial position of the business

5. Profit and loss knowledge

Definition of Accounting – Tally ERP 9 Notes English pdf

Accounting is the process by which financial transactions have to be identified, entered and processed by preparing a report. By which the financial position of the business can be known, it is called accounting.

Basic Accounting Terms – Terminology of tally

Business: –

The legal work done for the purpose of making profit is called business. Business is a broad term under which business, Production work, Sale or purchase of goods or services, Bank, Insurance, Transport companies come under it.

Types of Business

1.Manufacturing (production)

2.Trading (Sales)

3.Servicing (Service)

Trade (Business):-

The sale and purchase of goods done for the purpose of making a profit is called trade.

Profession (Profession or profession): –

Any work or means done to earn income which requires prior training, The profession is called – Doctor, teacher, Work of lawyer etc. comes under occupation.

Proprietor (Owner or Owner): –

The person starting the business, who arranges for the necessary capital and carries the risk of loss and loss of the officer to receive the profit., The owner of the business is called.

Capital (Capital)

Money to start a business by the owner of the business, It is imposed as cash or other property, it is called capital. In the business, the capital is employed for the purpose of profit, that part of the profit which is not removed from the business,Capital: – Assets – Responsibilities

Drawing (Withdrawal)–

Goods or cash which are taken out by the owner of the business for personal use of the business, This is called withdrawal or personal expenditure. Withdrawal reduces the amount of capital.

Transaction (Transaction or transaction):– Tally erp9 notes english

Double sided currency, Mutual exchange of goods or services ;Mgbindhamdh is called a Saunde transaction. Purchase and sale of goods, Economic activities such as payment and payment etc. are called commercial transactions or transactions.

Types of Transaction

1. Cash Transaction (Cash transaction)

2. Credit Transaction (Credit or credit transaction)

3. Bill Transaction (Bill transaction)

Goods (Goods)

The goods are called that thing, Which is traded – traded or traded. Raw material obtained for the manufacture of goods under goods, Can be semi-finished material or finished goods

Purchase (Purchase)

When goods are purchased for sale by the merchant, It is called purchasing. It can be purchased in the form of raw material or finished goods. Purchase of properties, Purchase not included, Because they are not for resale.

Purchase Return (Purchase return)

Goods that are returned due to any of the purchased goods, Purchase return or outward return (to him)Return Outward) It is said.

Sales (Sales)

When the purchased goods are sold for the purpose of profit, it is called selling. Cash sale to sell cash goods (Cash Sales) And sale of credit to sell goods (Credit Sales) it is said.

Sales Return (Sales return)

Any goods sold are returned by the customer due to any reason, This is called sales return or internal return. In the lobbySales return On entry, it is entered into a journal voucher or debit note.

Stock (Stock or stock)

After a certain period of time, It is called a stock, on the last day of a business year, which remains unsold, the last stock (Closing Stock) It is said. This stock at the beginning of the new business year, Initial stock (Opening Stock) It is called.

Assets (Assets):–

All such permanent and temporary items of business which are necessary to run the business and which are owned by the businessman, The assets are called. Like – machine, All instruments used for personal use of land and business, Furniture, The printer, Computer etc.

Types of Assets

1. Fixed Assets Permanent Property () – Equipment, All instruments used for personal use of land and business, Furniture, The printer, Custom etc.

2. Current Assets Movable property (cash) – cash. Bank cash etc.

Basic Accounting Terms

Liabilities (Liability or Liabilities):–

The liability of the business is called liability. There are some essential states in the business., Those who have the obligation to repay the business like – Capital, Bill of credit, Creditor, Bank overdraft etc.

Revenue (Revenue): –

Revenue refers to the amount received regularly from the sale of goods or services. Business day-to-day activities like rent – rent, Interest, The commission, Discount, Dividends etc. are also called revenue.

Expenses (the expense):-

Goods in business, Costs incurred for producing or acquiring goods and services. The expenditure is called. Payments for receipt of goods and services are covered under expenditure. wage, The freight, Salary paid on delivery and sale of railway carriages and goods, The rent, advertisement, the expense, Insurance is also included in the expenditure. The cost of increasing the revenue in brief is called expenditure.

Types of Expenses

1. Direct Expenses –

Payment for receipt of goods and services – wages, The freight, Payment on delivery and sale of railway carriages and goods

2. Indirect Expenses –

increase revenue, the wages, The rent, advertisement, the expense, Insurance etc. Expenditure (Spend): – Spend is the amount paid to increase the profit-earning capacity of the business. Expenses that are paid for the acquisition or acquisition of assets in a business are called expenses.

Gain (Benefit):-

this Is a kind of monetary gain, Which results from business like if 1,00,000 Goods worth Rs. 1,50,000 If sold in rupees 50,000 Receipt of money will be called profit.Basic Accounting Terms

Cost (Cost):-

Raw materials used in business and its functions, Service and loan, The sum of all direct and indirect expenses to be produced or used to make it useful is called cost of goods. The item includes the raw material or assets.

Discount (Deduction, Discount or discount): ‘-

Concession granted to the concession given by the merchant to his customers, It is called discount or discount. It is also called a gift. There are two types of discount –

1. Merchant discountTrade Distcount) : – The seller makes a discount (discounted) to his customers in the face value, ie the list price, while purchasing the goods., It is called a trade discount with the aim of increasing the sale of goods. It is not done in the accounting books

2. Cash discountCash Discount): – Exemption provided for payment of cash or check value in a fixed or fixed period, It is called cash discount, it is used in books of accounts.

Debitor (Debtor or debtor): –

The person, Borrow goods or services from a firm or institution, It is called the debtor or debtor of the business. To debtors’sundry debtors’;It is said that Nainkantal.

Creditor (Creditor or debtor): –

The person, Goods or services are borrowed from a firm or institution, it is called a creditor or a creditor. ‘sundry creditors'(Sundry Creditors) It is said. Like – from Lakhan Shyam2 The printer 20000 Bought for Rs. Receivable (Receivable): Any amount related to business which is to be obtained is called receivable. The buyer is called a debtor when there is a credit sale of goods in the trade, Through which funds are to be obtained Basic Accounting Terms

LiabilitiesPayable) –

There are certain amounts in the business which the merchant has to repay in future.Payable) It is said. Those from whom credit is purchased by trade are creditors of the trade (Creditors) It is said.

Entry (Entry): –

Entering the transaction in the books of account is called Entry.

Whole sale (Turn Over) –

The sum of the cash and credit sales that occur in a certain sum is the total sales or Turn over It is said. Sales cash = sales creditTurn over

Insolvent / Bankrupt: –

A person who is unable to repay his loan is called bankrupt. The liability of such a person is more than the value of his property. In such a situation, he cannot repay his loan in full. He has to take refuge in the court to partially repay the debt. The court allows him to partially repay the debt by declaring him bankrupt, thereby freeing him from his debt.

Bad Debts / Debt: –

Unable to recover the amount due to the inability of the debtor or going bankrupt, For a creditor, it is called bad debt or unapproachable loan.

Debit and credit (Debit and Credit): –

Each account has two sides. The left side is called the debit compound or the deviation and the right side is called the deposit centroid or the integral. Accounting on the left side of an account is called a debit account, which is traditionally abbreviatedDr. It is thus written that accounting on the right side of the account is called deposit account, which is traditionally Cr. Let’s write It is noteworthy that in Indian bookkeeping system, the debit side is on the right and the deposit is on the left.

Commission / Commission or revocation: –

Representative or agent in return for cooperating or representing in business activities ;The remuneration paid to Hamdjad is called Kamshin.

Company (Firm): –

In a general sense, a firm refers to an entity that establishes a partnership or does a business or business function, but in a broader sense each business entity can be referred to as a firm.

Account / Leger / Account :-

Ledger or ledger is a table in which soida are classified according to their nature and are written in order at a place under a heading in simple words., The list that is made after sorting the accounts related to property and income, etc., is an account or ledger.

Account The word is abbreviated in English A / c it happens. This abbreviated form is often used in articles and each account is divided into two sides. Debit the left sideDebit And right side Credit They say

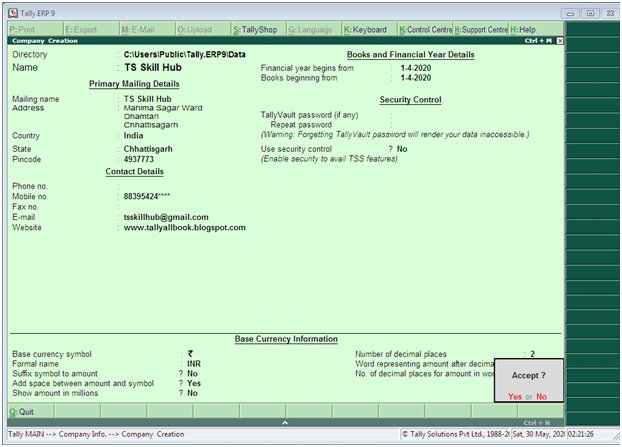

How to Create Company in Tally ERP 9 Notes English pdf

Tally To work in User mainly 4 To do work –

- Company Creation (Company making)

- Ledger Creation (Laserbana)

- Inventory Management (stock management)

- Voucher Entry (Voucherentrike)

When we first started a business, Shop, Want to manage the organization or firm in tally , So the first thing to be done is to create a company in the name of that firm. These companies are formed before the start of work in the tally.

Company Creation Tally ERP 9 Notes (Company formation)

Follow the following steps to create a company in a tally –

1. Go to company info menu

2. Create Company Select the option of

3. Shortcut key Alt + F1 Or shortcut key Alt + F3 By going toCreate Company Choose Option .

As soon as we choose this option company creation Of window Will open in which fill the information sought and Ctrl + A button Press and save.

Details to be filled in company creation window

Fill Basic Data

- Directory – This field is already full, this field contains the path of the tally , Where Tally Software Loads The cursor leaves this field and the company to be created automatically stores it in this directory.

- Name – Enter that name in this field , Name by which you want to create a company like Trisha Pvt Ltd.

- Mailing Name – Enter the company’s mailing name in this field. The name of the company is usually the malting name.|

- Address – The complete address of the company is maintained in this field.

- State – In this field, enter the state in which your business is established.

- Pin code – Enter the pin code of the place in this field , Where the companies are established

- Telephone Number – Enter the company’s telephone number in this field.

- E-mail Address – Enter the company’s email address in this field.

- Website – Enter the company website in this field

Books and financial year details

- Financial Year From – Enter the starting date of the financial year in this field like – 01 – Apr – 2019

- Books Beginning From – Enter the dates of opening of books of accounts in this field, such as – 01 – Apr – 2019 .

- Security control – If you want to activate security on the company , So try this option and enter it after entering the user name and password.

Base Currency Information

All these fields are autofill, you can change as per your requirement.

Base currency symbol

- Formal name

- Suffix symbol to amount?

- Add space between amount and symbol?

- Show amount in millions?

- Number of decimal places

- Word representing amount after decimal

- Number of decimal places for amount in words

Now after filling all the information in the last ,By pressing the enter button or Ctrl + A Save the information by pressing the button.

Select company in tally Select company Tally ERP 9 Notes

Gateway of Tally – F1 (Select Company)

or

Gateway of Tally – Alt + F1 (Select Company)

or

Gateway of Tally – Alt + F3 (Select Company)

Alter company in tally Revise company – Tally ERP 9 Notes

If you want to make any kind of change in an already created company , So from the gateway of tally F1 Select the company by pressing the key , In which you want to change. After selecting the companyAlt + F3 Press key , Which will display the Company Info menu. Select the Alter option from here. This will display the company alteration screen. After making changes to it, save it.

- Gateway of tally

- Press F1 (Select the Company)

- Alt + F3

- Alter 4 Select company

Delete comapy in tally Company removal – Tally erp9 notes english

any company To delete First to that company To select Do it AgainAlt + F3 From company infon menu by pressing key Alter Select the option. Select the company you want to delete and after selecting itAlt + d Use the key. Due to which the selected company will be deleted.

- Gateway of tally

- Press F1 (Select the Company) Alt + F3

- Alter

- Select company

- Alt + d

What is Ledger and how to create in tally Tally ERP 9 Notes?

What is Ledger and how to create in tally?

Creating a Ledger in Tally – Tally ERP 9 Notes

Account / Ledger / Account :- Ledger or ledger is a table in which soida According to their nature, a person is written in a simple sequence in a place under a title., From property and income etc. The list that is made after sorting related articles is ledger or ledger.

Account The word is abbreviated in English A / c it happens. This abbreviated form is often used in articles and each account is divided into two sides. Debit the left sideDebit And right side Credit They sayLedger or account creation in Tally (): – Tally In order to make a laser, we follow the following steps –

- Gateway of tally

- Accounts Info

- Ledgers

- Create

If you follow these steps, it will be dialed4 Box appears

There are two ways in which we can create an account in Tally1. Single Ledger 2. Multipal Ledger 1. Single Ledger -Through this option, only one account can be created at a time.

2 . Multipal Ledger -Through this option at once more than one Accounts Can build

What is voucher ?

Inventory Voucher: What is Voucher – Voucher is a type of written statement detailing all Financial or Non-Financial transactions. voucher is an important part of the business, it uses Voucher in all types of business. In Tally we are Voucher Entry accordingly.

Types of Voucher –

- Accounting Voucher

- Inventory Voucher

Accounting voucher

Accounting voucher is the voucher in which the book is maintained according to financial transactions .

Types of Accounting Vouchers

| Contra Voucher (F4) | Payment Vouchers(F5) | Receipt Voucher (F6) |

| Journal Vouchers (F7) | Sales Vouchers (F8) | Credit Note Voucher (Ctrl + F8) |

| Purchase Vouchers (F9) | Memo Voucher (Ctrl + F10) | Debit Note Voucher ( Ctrl + F9) |

1- Contra Voucher :- Accounting Vouchers

The contra entry represents the following types of fund transfers.

• Cash A/c To Bank A/c

• Bank A/c To Cash A/c

• Bank A/c to Bank A/c

Follow the following steps to use Contra Voucher

A- Gateway of Tally > Accounting Vouchers

B- press F4 Button

Payment Voucher :- Accounting Vouchers

Follow the following steps to use Payment Voucher

A- Gateway of Tally > Accounting Vouchers

B- F5 Button press

Journal Voucher :- Accounting Vouchers

It is an accounting voucher used to adjust debit and credit amount without including it in cash or bank accounts.

Journal Voucher follow the following steps to use :-

A- Gateway of Tally > Accounting Vouchers

B- F7 Button press

Receipt Voucher :-

It is an accounting voucher. This voucher is used when a party or other way receives a beverage or amount.

Follow the following steps to use Receipt Voucher

A- Gateway of Tally > Accounting Vouchers

B- press F6 Button

Sales Voucher :-

It is an accounting voucher which is used when a sales transaction is made.

Follow the following steps to use Sales Voucher:

A- Gateway of Tally > Accounting Vouchers

B- F8 Button press

Purchase Voucher :-

It is an accounting voucher which is used when purchase Transaction.

Follow the following steps to use Purchase Voucher

A- Gateway of Tally > Accounting Vouchers

B- F9 Button press

What is Inventory Voucher?

What is Inventory Voucher – the way Accounting Voucher work in Accounting System. Similarly, inventory is in vouchers, it Record of goods received or sent.

Go to the Gateway of Tally > Inventory Vouchers to see it.

Activate Inventory Voucher

To work on inventory vouchers, we have to follow the instructions given below:

- Go to Gateway Tally.

- press F11 Feature button.

- press the F2 button or select the inverntory features.

- Integrate Accounts and Inventory – Yes.

- Enable Purchase Order Procesing – Yes.

- Enable Sales Order Processsing – Yes.

- Use Rejection inward and outward notes – Yes.

- Use Material in and out Vouchers – Yes.

Thus, after all the setting, save the ctrl + A button by press. You’ll inverntory Voucher activate after save.

Types of Inventory Voucher in Tally ERP 9 / Types of Inventory Vouchers

- Receipt Note (Alt + F9)

- Delivery Note (Alt+F8)

- Rejection Out (Alt+F6)

- Rejection In (ctrl+F6)

- Stock Journal (Alt+F7)

- Physical Stock (Alt + F10)

- Sales Order (Alt+F5)

- Purchase Order (Alt+F4)

Tally has various inventory vouchers available through which we can stock managment or inverntory managment.

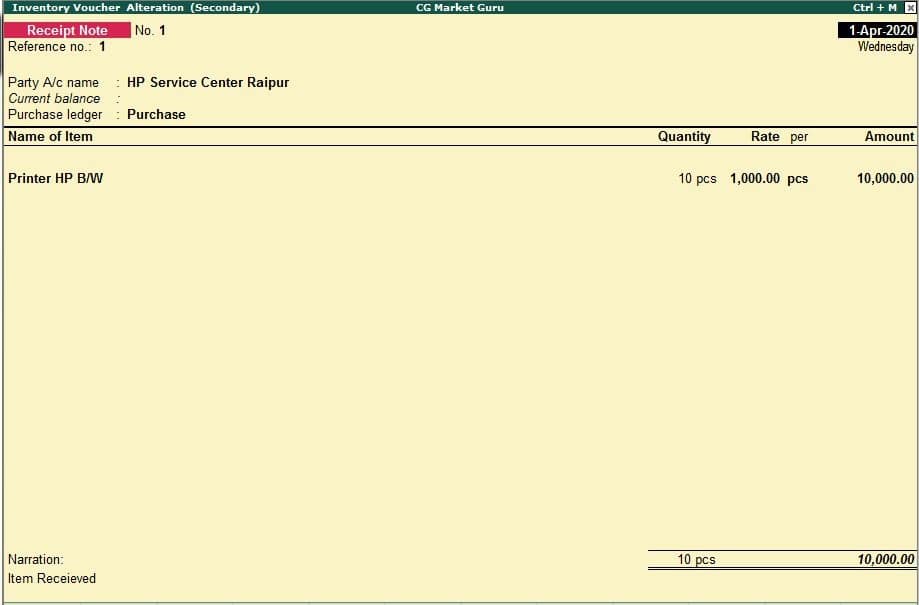

Receipt Note Voucher

What is Receipt Note Voucher – it is a inventory voucher through which we can use order given goods/goods for purchase. receipt note is Entry when Goods is received. entry in Receipt Note, our stock begins to appear. Receipt Note Voucher has a shortcut key Alt + F9.

Delivery Note Voucher

What is Delivery Note Voucher – it is a inventory voucher through which we receive order for Sales on goods/goods. the Delivery Note Voucher is Entry after sending the Goods. Our stock decreases as soon as we entry in the Delivery Note Voucher. Delivery Note Voucher has a shortcut key Alt + F8.

Rejection Out Voucher

What is Rejection Out Voucher – it is a inventory voucher through which we purchase the goods given order/goods. When Goods is received, the item is returned from some item damage or any other reason. Then entry is done in Rejection Out Voucher. As soon as we entry in the Rejection Out Voucher, our item of the stock begins to decrease. Rejection Out Voucher has a shortcut key Alt + F6.

Rejection In Voucher

What is Rejection In Voucher – it is a Inventory Voucher through which we have received order for Sales/goods. When Goods is deliver, it comes back to item from some item damage or any other reason. Then entry is done in Rejection In Voucher. As soon as we entry in the Rejection in Voucher, our item of stock begins to look more visible. Rejection in Voucher has a shortcut key Alt + F7.

Stock Journal Voucher

What is Stock Journal Voucher – it is a inventory voucher through which we transfer stock from one godown to another godown stock.

For example – we have a godown, the first home godown and the second office godown in which we keep stock.

Stock Journal Voucher is also used for Manufacturing process in which Raw Material is transfer in Finished Goods.

Physical Stock Voucher

Physical Stock Voucher is used to record the actual stock, which can be Verify or Count. When we don’t match stock and physcial stock written in our books, we difference stock entry we do it in Physical Stock Voucher.

Sales Order Voucher

What is Sales Order Voucher – it is a inverntory voucher through which we can use goods/goods for Sales. Goods order, which we Entry in Sales Order Voucher. entry in Sales Order Voucher does not make any difference in stock. the stock is reduced only when Sales Order is entry in Delivery Note Voucher. Sales Order Voucher has a shortcut key Alt + F5.

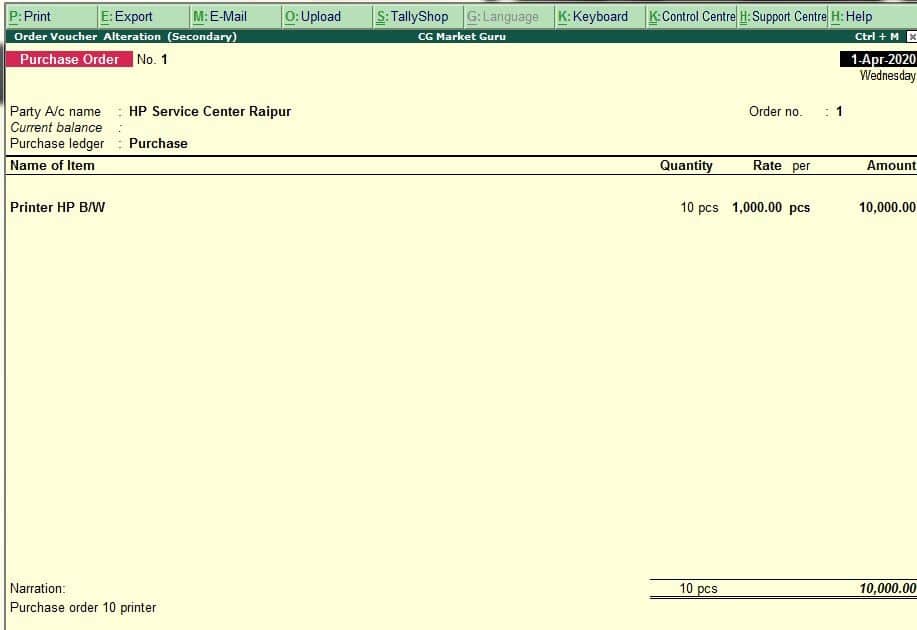

Purchase Order Voucher

What is Purchase Order Voucher – it is a inverntory voucher through which we purchase goods/goods for the purchase. Goods order, which we Entry in Purchase Order Voucher. entry in Purchase Order Voucher does not appear in stock. Purchase Order stock add only when entry in Receipt Note Voucher. Purchase Order Voucher has a shortcut key Alt + F4.

Golden Rules of Voucher Entry

| key | Voucher | Dr/Cr | Cash Deposit | Dr/cr | Cash Withdraw |

| F4 | Contra | Cr | To Cash A/c | Cr | To Bank A/c |

| Contra | Dr | Bank A/c | Dr | Cash A/c | |

| F5 | PAYMENT | Party Payment | Expences Payment | ||

| PAYMENT | Dr | Party Name A/c | Dr | Expences A/c | |

| PAYMENT | Cr | Cash / bank A/c | Cr | Cash / bank A/c | |

| F7 | JURNEL | Purchase Return | Sales Return | ||

| JURNEL | Dr | Party Name A/c | Dr | Sales Return | |

| JURNEL | Cr | Purchase Return | Cr | Party Name A/c |

| F6 | RECIPT | Party Receipt | Income Receipt | ||

| RECIPT | Cr | Party Name A/c | Cr | Income Name A/c | |

| RECIPT | Dr | Cash / bank A/c | Dr | Cash / bank A/c | |

| F8 | SALES | Cash Sales | Credit Sales | ||

| SALES | Dr | Cash / bank A/c | Dr | Party Name A/c | |

| SALES | Cr | Sales A/c | Cr | Sales A/c | |

| F9 | PURCHASE | Cash Purchase | Credit Purchase | ||

| PURCHASE | Cr | Cash / bank A/c | Cr | Party Name A/c | |

| PURCHASE | Dr | Purchase A/c | Dr | Purchase A/c |

Tally erp 9 notes in english pdf free download with examples

Journalize the following transactions

1. Commenced business with cash Rs.10, 000.

2. Deposit into bank Rs. 15,000

3. Bought office furniture Rs.3,000

4. Soled goods for cash Rs.2,500

5. Purchased goods form Mr X on credit Rs.2,000

6. Soled goods to Mr Y on credit Rs.3,000

7. Received cash form Mr. Y on account Rs.2,000

8. Paid cash to Mr X Rs. 1,000

9. Received commission Rs. 50

10. Received interest on bank deposit Rs. 100

11. Paid into bank Rs. 1,000

12. Paid for advertisement Rs.500

13. Purchased goods for cash Rs. 800

14. Sold goods for cash Rs. 1,500

15. Paid salary Rs. 500

| Key | Voucher | Ledger | Group | Type of account | Principles | Amount | |

| 1 | F6 | Receipt | Cr. Capital | Capital account | Personal | Giver | 10,000 |

| Dr. Cash | Cash in hand | Real | Comes in | 10,000 | |||

| 2 | F4 | Contra | Cr. Cash | Cash in hand | Real | Goes out | 15,000 |

| Dr. Bank | Bank account | Real | Comes in | 15,000 | |||

| 3 | F5 | Payment | Dr. Office furniture | Fixed asset | Real | Comes in | 3,000 |

| Cr. Cash | Cash in hand | Real | Goes out | 3,000 | |||

| 4 | F8 | Sales | Dr. Cash | Cash in hand | Real | Comes in | 2,500 |

| Cr. Sales | Sales account | Real | Goes out | 2,500 | |||

| 5 | F9 | Purchase | Cr. X | Sundry creditor | Personal | Giver | 2,000 |

| Dr. purchase | Purchase account | Real | Comes in | 2,000 | |||

| 6 | F8 | Sales | Dr. Y | Sundry debtors | Personal | Receiver | 3,000 |

| Cr. Sales | Sales account | Real | Goes out | 3,000 |

| 7 | F6 | Receipt | |||||

| Dr. cash | Cash in hand | Real | Comes in | 2,000 | |||

| 8 | F5 | Payment | Dr. X | Receiver | 1,000 | ||

| Cr. Cash | Cash in hand | Real | Goes out | 1,000 | |||

| 9 | F6 | Receipt | Cr. commission | Indirect income | Nominal | Credit all income | 50 |

| Dr. cash | Cash in hand | Real | Comes in | 50 | |||

| 10 | F6 | Receipt | Cr. Interest on bank deposit | Indirect income | Nominal | Credit all income | 100 |

| Dr. Bank | Bank account | Real | Comes in | 100 | |||

| 11 | F4 | Contra | Cr. Cash | Cash in hand | Real | Goes out | 1,000 |

| Dr. Bank | Bank account | Real | Comes in | 1,000 | |||

| 12 | F5 | Payment | Dr. Advertisement | Indirect expenses | Nominal | Debit all expenses | 500 |

| Cr. Cash | Cash in hand | Real | Goes out | 500 | |||

| 13 | F9 | Purchase | Cr. Cash | Cash in hand | Real | Goes out | 800 |

| Dr. purchase | Purchase account | Real | Comes in | 800 | |||

| Cr cash | |||||||

| 14 | F8 | Sales | Dr. cash | Cash in hand | Real | Comes in | 1,500 |

| Cr. Sales | Sales account | Real | Goes out | 1,500 | |||

| 15 | F5 | Payment | Dr. salary | Indirect expense | Nominal | Debit all expenses | 500 |

| Cr. Cash | Cash in hand | Real | Goes out | 500 |

Company 2 – journal / voucher entry the following transactions in the accouting book of shri Kushal Cloth Store.

Fy – 2021 – 2022

Books Begining from – 2021

Address – Ghadi Chowk Dhamtari Chhattisgarh Pin – 493773

- Shri kushal cloth store started from Rs. 5 lakh.

- Opened an account with SBI Bank Dhamtari for Rs. 3 lakhs.

- Purchased furniture worth Rs 10,000 for the shop.

- Purchased clothes worth Rs 2 lakh from Shree Cloth Store Raipur and gave 12% GST.

2000 rupees of electricity bill. - Gave 100 rupees for tea Nasta.

- 1500 bill of telephone bill paid by check.

- Interest of Rs. 1500 was received from SBI Bank.

- 5000 rupees of rent paid by check.

- Sold clothes worth Rs. 1 lakh to Shri Trisha Cloth Center Colliery with 12% GST.

- The train fare was given 2500 rupees.

- Shree Cloth Store Raipur sent back the clothes of 15000 rupees on receipt of damage.

- Office maintenance given 2000 rupees.

- Withdraw 5000 rupees from SBI Bank for petty cash.

- Shree Trisha returned from Cloth Center Colliery due to damage of clothes worth Rs 10 thousand.

- Bank of Baroda Bank got a check of 90 thousand rupees from Shri Trisha Cloth Center Colliery.

- Paid 50 thousand rupees to Mr. Cloth Store Raipur and received 5 percent cash discount.

- The clothes worth 2 thousand rupees have deteriorated.

- Purchased a computer system of Rs. 15000 for the shop.

- 5000 rupees given for the decoration of the shop.

- Rs 5000 given for decoration of shop.

Solution –

Before entering Voucher in Tally, we have to create the ledger of all the transactions, so let’s first create the ledger –

1- Go to the gateway of tally

2- Accounts Info

3- Select Ledger

4- Create

Now the screen of the ledger creation will be displayed in front of you, in which create all the ledger one by one and yes to the GST while creating the GST Ledger and fill the relevant information.

Now we have to do important work in which we will create a Stock Item for GST Entry, in which we will carefully input GST Rate.

| Ledger | Ledger Under Group |

|---|---|

| Capital A/c | Capital Account |

| SBI Bank Dhamtari | Bank Account |

| Furniture A/C | Fixed Account |

| Purchase A/c | Purchase Account |

| SGST | Duties & Taxes |

| CGST | Duties & Taxes |

| IGST | Duties & Taxes |

| Shri Cloth Store Raipur | Sundry Creditor |

| Electricity Bill A/c | Indirect Expenses |

| Food & Snacks | Indirect Expenses |

| Telephone Bill A/c | Indirect Expenses |

| Bank Interest Received A/c | Indirect Income |

| Rent | Indirect Expenses |

| Trisha Cloth Cneter | Sundry Debitor |

| Sales | Sales |

| Wages A/c | Direct Expenses |

| Purchase Return A/c | Purchase Account |

| Petty Cash A/c | Cash Account |

| Sales Return | Sales |

| Cash Discount Received A/c | Indirect Income |

| Cloth Damage | Indirect Expenses |

| Computer System A/C | Fixed Assets |

Transaction 1- 5 lakh rupees shri kushal cloth store started.

Voucher entry in Receipt Voucher F6

Capital A / c Dr. 500000

to Cash Cr. 50000

(Shri kushal cloth store started from 5 lakh rupees.)

Transaction 2. Opened an account with SBI Bank Dhamtari for Rs. 3 lakhs.

Voucher entry in Contra Voucher F4

SBI Bank Dhamtari A / c Dr. 300000

to Cash A / c Cr. 300000

(Account opened in SBI Bank Dhamtari with Rs. 3 Lakh)

Transaction 3. Purchased furniture of Rs. 10000 for the shop.

Voucher entry in Payment Voucher

Furniture A / c Dr. 10000

to Cash A / c cr. 10000

Purchased furniture worth Rs 10,000 for the shop.

Transaction 4. Purchased clothes worth Rs 2 lakh from Shree Cloth Store Raipur and gave 12% GST.

Voucher entry in purchase Voucher

Purchase A / c Dr. 200000

CGST A / c Dr. 12000

SGST A / c Dr. 12000

to shri cloth store raipur ac 224000

(Buy clothes worth Rs 2 lakh from Shree Cloth Store Raipur and give 12% GST)

Transaction 5. 2000 rupees of electricity bill.

Voucher entry in Payment Voucher

electricity bill A / c Dr. 2000

to cash ac / c cr. 2000

(2000 rupees of electricity bill.)

Transaction 6. Gave 100 rupees of chai nasta.

Voucher entry in Payment Voucher

Food & Snacks A / c Dr. 100

to Cash A / c Cr. 100

(Tea Nasta given 100 rupees)

Transaction 7. 1500 bill of telephone bill paid by check.

Voucher entry in Payment Voucher

Telephne Bill Dr. 1500

SBI Bank A / c Cr. 1500

(1500 bill of telephone bill paid by check)

Transaction 8. Interest of Rs. 1500 was received from SBI Bank.

Voucher entry in Receipt Voucher

SBI Bank A / c Dr. 1500

Bank Interest Received A / c Cr. 1500

(Interest of Rs. 1500 received from SBI Bank)

Transaction 9. 5000 rupees of rent paid by check.

Voucher entry in Payment Voucher

Rent A / c Dr. 5000

SBI Bank A / c Cr. 5000

(5000 rupees of rent paid by check)

Transaction 10. Sold clothes worth Rs. 1 lakh to Shri Trisha Cloth Center Colliery with 12% GST.

Voucher entry in Sales Voucher

Shri Trisha cloth Center 112000

Sales A / c Cr. 100000

CGST A / c Cr. 6000

SGST A / c Cr. 6000

(1 trillion rupees sold to Shri Trisha Cloth Center Colliery with 12% GST)

Transaction 11. The train fare was given 2500 rupees.

Voucher entry in Payment Voucher

Wages A / c Dr. 2500

Cash A / c Cr. 2500

(2500 rupees for train fare)

Transaction 12. Shree Cloth Store Raipur sent back on 15000 rupees after receiving damage.

Voucher entry in Journal Voucher

Shri Cloth Store Raipur Dr. 15000

to Purchae Return A / c Cr. 13800

to CGST A / c Cr. 600

to SGST A / c Cr. 600

(Shree Cloth Store Raipur sent back on receipt of Damage of Rs. 15000)

Transaction 13. Office maintenance given 2000 rupees.

Voucher entry in Payment Voucher

Office Maintenance A / c Dr. 2000

Cash A / c Cr. 2000

(Office maintenance 2000 rupees given)

Transaction 14. Withdraw 5000 rupees from SBI Bank for petty cash.

Voucher entry in Payment Voucher

Petty Cash A / c Dr. 5000

SBI Bank A / c Cr. 5000

(Withdraw 5000 rupees for petty cash from SBI bank)

Transaction 15. Shri Trisha returned from Cloth Center Colliery due to damage of clothes worth Rs. 10 thousand.

Voucher entry in Journal Voucher

Sales Reutrn A / c Dr. 8800

CGST A / c Dr. 600

SGST A / c Dr. 600

to Tirsha Cloth Center A / c Cr. 10000

(Shri Trisha Cloth Center returned from colliery due to damage of clothes worth Rs. 10 thousand)

Transaction 16. Bank of Baroda bank check received from Shri Trisha Cloth Center Colliery for Rs. 90 thousand.

Voucher entry in Receipt Voucher

SBI Bank Dhamtari A / c Dr. 90000

to Trisha Cloth Center Cr. 90000

(Check of Bank of Baroda Bank got check of Rs. 90 thousand from Shri Trisha Cloth Center Colliery, Check Number 461556.)

Transaction 17. Paid 50 thousand rupees to Mr. Cloth Store Raipur and received 5 percent cash discount.

Voucher entry in Payment Voucher

Shri Cloth Store Raipur Dr. 50000

Cash Discount Received Cr. 5000

Cash A / c Cr. 45000.

(Paid Rs. 50 thousand to Mr. Cloth Store Raipur and received 5 percent cash discount)

Transaction 18. 2 thousand rupees of clothes went bad.

Voucher entry in Journal Voucher

Cloth Damaged A / c Dr. 2000

to Purchase A / c Cr. 2000

(2 thousand rupees of clothes spoiled)

Transaction 19. Purchased a computer system of Rs. 15000 for the shop.

Voucher entry in Payment Voucher

Computer System Dr. 15000

to Cash A / c Cr. 15000

(Purchased a computer system of Rs. 15000 for the shop)

Transaction 20. Rs 5000 given for decoration of shop.

Voucher entry in Payment Voucher

Office Maintenance A / c Dr. 5000

Cash A / c Cr. 5000

(Office maintenance given Rs. 5000)

very good useful notes

Its beautiful and very useful for knowing Tally.ERP9.

SIMPLY SUPERB !

IT IS REALLY NICE TO LEARN FROM THIS WITH NICE EXAMPLES. I REALLY APPRECIATE AND THANKFUL TO YOU SINCE I AM NEW TO TALLY AND NOW I AM WORKING WITH TALLY IN MY OFFICE.

THANK YOU SO MUCH.

thank your

NICE VERY USEFUL NOTES

Thanks brother

welcome brother

Very useful notes ,it helped me lot. Only the thing is some spelling mistakes r seen in ur notes, like for cheque its been written check.. , for 50 thousand it can also be written as Rs 50,000/- etc….Else very smartly displayed which can be understood ….best luck..

Thannk for your feedback

Thanx for the notes

Very helpful for us .